BY CARRIE MYERS

When Jennie* decided to begin her own fitness business, she was pretty clueless about the tax-end of things. “I had no idea what a deductible was, let alone what would be considered one.”

Jennie isn’t alone. As former-pro-football-player-turned-certified-public-accountant Luke Sniewski says, “Fitness professionals sometimes forget they’re a legitimate business, and often focus so much on the fitness role that they forget the ever-important role as a [business] professional.”

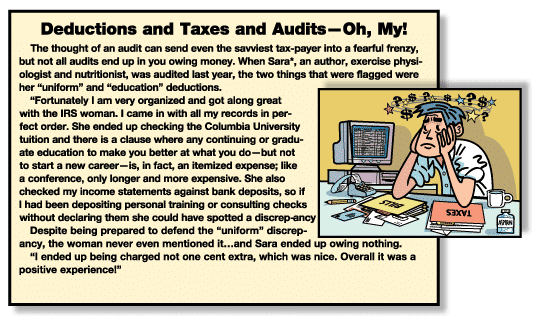

Sniewski, also a certified personal trainer, adds that being organized and knowledgeable about tax deductions can mean the difference between a tax bill and a tax refund—or in some cases, a tax penalty. Dave* learned this lesson when business—and subsequent income—at his karate studio increased exponentially in one year.

“My first couple of years in business I paid my taxes once a year, after my tax return was figured out. But as my business was increasing, little did I know I should have been paying quarterlies. The IRS penalized me for this mistake.”

He adds that you can also be penalized if you are paying quarterlies, but are paying too little. “I highly recommend at least consulting with an accountant so that you have a plan and can head off any potential issues that may cost you in the end.”

Ryan Himmel, C.P.A., founder and CEO of BIDaWIZ.com, agrees. “Consulting with an accounting professional is time and money well-spent, especially if you aren’t sure how to handle your books. These professionals can foresee potential accounting issues that you may not [be aware of] at first.”

“Just like clients ask fitness professionals for help with their fitness strategies, fitness pros should take advantage of the financial resources around them,” adds Sniewski. “Everyone needs some kind of tax plan or strategy to make sure they’re on the right financial track. You don’t want to be surprised by a huge tax bill when your focus should be on helping people reach their goals.”

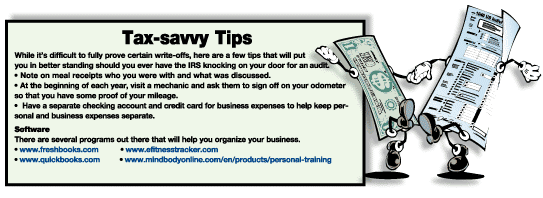

Dave found that besides using a tax professional, the other aid that helped him focus on his clients was going computerized. “There’s plenty of software out there, even ones specifically made for fitness businesses. While I used to do everything on paper, I now use a program that allows me to track client payments, add notes to their profiles, and put reminders on their accounts. This has increased my efficiency—and, therefore, my teaching time.”

“Many business owners overlook the importance of keeping their books updated on a real-time basis,” says Himmel. “Take the time to make the investment so that you can do your taxes properly come tax time.”

When Dave first opened his studio, he tossed all his receipts into one big envelope, then sifted through and divided them out at the end of the year. He still uses a big envelope, but he goes through all his receipts at the end of each month and prepares a spreadsheet for that month. This makes tax time much easier.

“I’ve come up with as many categories as I could think of for deductibles and categorize my expenses with as much detail as possible.” For instance, while some people may have one “meals” category, Dave divides it up according to “breakfast,” “lunch,” and “dinner.” “This may not be totally necessary, but this way I know exactly what my money is going toward.”

Regardless of whether you’re prepared or organized for this tax year, it’s never too late to become so. “Take what you’re learning from this tax season to make next year an easier experience,” recommends Phil Liberatore, C.P.A., founder and manager of Your IRS Problem Solvers, Inc. in Southern California. “Keep a notepad near while you prepare your taxes and write down anything useful to improve or start your system.”

Liberatore suggests asking yourself these questions:

- What did I have to hunt for?

- What would have made the process easier?

- What categories do I need to add or subtract for next year?

- How much time did I spend filing my taxes this year? What is my goal for next year?

- How can I organize my taxes even more?

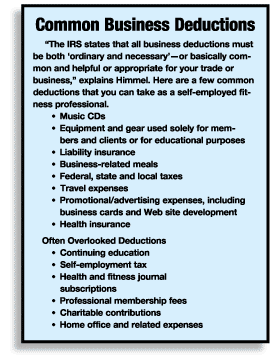

One error our experts agreed on that many business owners make is not claiming all they can on their taxes. “You might be surprised how much of your everyday expenditures can be deductible as legitimate business expenses,” explains Liberatore.

“Let’s say a trainer makes $50,000 and spends $25,000 on business expenses,” explains Sniewski. “If that trainer simply ignored the deductions, he would pay taxes on the taxable income of $50,000. We’ll estimate it as $20,000 in taxes. However, if the trainer recognized the deductions and applied that $25,000 of business expenses, then the taxable income drops to $25,000 and lowers the tax bill to something more like $10,000.”

But what about those of you who aren’t self-employed and work for someone else? Can you take any deductions?

“Trainers employed by an employer can take most, if not all, of the same deductions as self-employed trainers,” says Sniewski. But, he warns, “the difference is where the deduction goes on the tax return and how much of the deduction actually creates a tax benefit.”

He suggests consulting a tax professional, as many times employed trainers make purchasing decisions based on ill-informed information, thinking they’ll get a tax benefit from it, when they really won’t. “In terms of creating potential tax deductions and benefits, it’s more beneficial to be a self-employed trainer.”

If you’re currently employed by someone else, and are itching to receive all these tax benefits—as well as the pride that goes with owning your own business—discuss with your current company’s management about hiring you as an independent contractor.

Regardless of whether you stay on as an employee or break off on your own—or have already done so—educate yourself as much as possible regarding taxes and the coinciding laws. After all, it is your hard-earned money; and while you should pay your fair share along with the rest of the nation, you should also take advantage of the laws that are set up to benefit your business and move you forward in your work.

*Names have been changed.

____________________________________________________________________________

CARRIE MYERS has a B.S. in exercise science and has been a freelance writer for more than 11 years. She’s the author of the award-winning book, Squeezing Your Size 14 Self into a Size 6 World: A Real Woman’s Guide to Food, Fitness, and Self-Acceptance, and presents, teaches and trains in New Hampshire and Vermont.